Article by: StorageCafe

Tucson developed more real estate over the last decade than 62% of large US cities. The Old Pueblo focused most strongly — more than any other Arizona city — on new retail space. It grew its office and industrial space by a lesser amount, but its residential sector was up to speed nationally, issuing permits equally for single family and multifamily building.

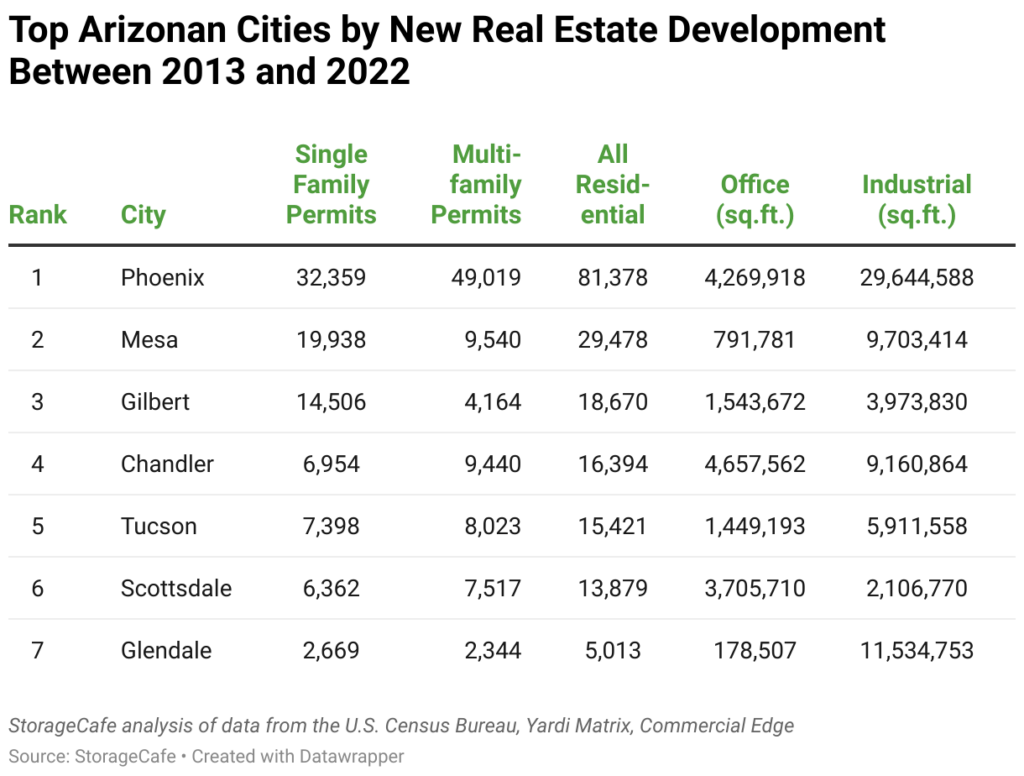

A recent study by StorageCafe ranked 100 of US’s largest cities by how much real estate, across several sectors, had been developed between the years 2013 and 2022. Texan and other Sun Belt hubs fill out the top spots, with Phoenix and Tucson getting sixth and 38th places, respectively. But Arizona cities score well overall, and Tucson’s real estate sector remains bolstered by its reasonable costs and a varied local economy that includes students, snowbirds and the military.

Tucson Residential Construction Is on a Par for the USA

Although Tucson saw less housing development over the 10 years than other Arizona cities, in terms of the combined total of housing permits issued, it makes the half-way mark in the list of 100 US cities. The Old Pueblo’s 2020-2022 population growth of 0.73% was only a third of Phoenix’s, but in-migration all across Arizona fuels housing demand. And Tucson’s reasonable median home value of $186K — two-thirds of Phoenix’s — enhances its attraction for newcomers.

Multifamily Development in Tucson Adds to a Good-Value Market

Tucson issued more than 1,000 multifamily permits in 2019, and then during subsequent years, despite the challenges, the annual numbers remained near to that level, helping keep the city’s average apartment rent at a comparatively reasonable $1,262 per month. And with almost half the city’s 219K households renting — a slightly higher ratio than in Phoenix — the local multifamily sector should have momentum to continue to see permits issued in the coming years.

Tucson’s Equally Active Single-Family Sector Encourages Suburban Living

Tucson has been issuing almost as many single families permits as multifamily permits, more in line with ‘suburban’ cities such as Scottsdale and Glendale and in contrast with Phoenix’s strong bias towards building apartment blocks. As Tucson is its own metropolitan area, it is also its own suburbs! The high availability of single-family homes combined with all the action of a large city is another factor in Tucson’s favor as a relocation destination.

Commercial Development in Tucson: Retail Leads the Way

Among Tucson’s commercial real estate sectors, retail was the best performer over the past decade. The office and industrial segments understandably had poor years after the pandemic had hit, but they recovered quickly, and development in the self-storage sector has also picked up considerably of late.

Tucson Built More Retail Than Any Other Arizona City

Tucson constructed more retail square footage than even Phoenix city over the past decade, despite having only a third the number of residents. Tucson’s retail sector was steady at the end of 2022, with vacancy rates stable at 6.2%. The local retail sector currently includes strong leasing activity for restaurants, plus car washes and outlets for groceries and auto parts, and it looks like there will be a new kid on the block in the form of cannabis dispensaries.

Development of Industrial Space in Tucson Revives After a 2020 Low

Over the past decade, Tucson built industrial space more slowly than many Metro Phoenix cities as a proportion of population, due in part to the city’s differently diversified economy. The first year of the pandemic closed workplaces, with Tucson constructing only 35K industrial square feet in 2020, a tenth the amount built the year before. However, activity picked up rapidly in 2021, when the city built 15 times more, before dropping somewhat from 2021 to 2022.

Tucson’s Office Space Sector Also Bounced Back and Stayed Vigorous

Similarly, Tucson built just 18K square feet of office space in 2020 — the previous month saw 20 times more constructed — but 2021’s office construction increased to 125K square feet. Unlike Tucson’s industrial sector, new office space in town then registered a similar increase to inventory in 2022. One factor encouraging office space development could be the comparatively low proportion of people working from home: 7.5% compared to Phoenix’s 10.1%.

Tucson’s Lagging Self Storage Development Accelerated Last Year

The self-storage sector’s reputation emerged from the pandemic years further enhanced among both clients and investors. While Tucson’s 10-year total addition of storage was low for Arizona, it includes a very confident quarter of a million square feet of space built in 2022 alone. And the cost is reasonable, with a standard storage unit in Tucson renting for an average of $116 per month, below the national average of $128.

Tucson’s high retail sector activity boosts the city’s real estate confidence overall. In addition, residential building in town has also been steady compared to national levels. And Tucson has certainly been no slouch when important real estate sectors needed to come back from the challenges of the last few years, providing momentum for the local real estate sectors going forward.